One of the first decisions you must make as a business owner is concerning payroll schedule. A payroll schedule determines how often you pay your employees. There are four types of payroll schedules to choose from, and we’ll go through them in this article, looking at their pros and cons and determining which suits what business.

Maintaining a payroll schedule seamlessly is possible with the right payroll app, like Gusto. With Gusto, you can keep track of employee hours, accurately calculate payments, deductions, and file taxes automatically for hassle-free paydays.

What is a Payroll Schedule?

A payroll schedule refers to the frequency with which you pay your employees. There are several types of payroll schedules, each suitable for different businesses.

To choose the right schedule for your company, it’s crucial to understand how each schedule works. You also must pay attention to other factors, such as state laws, that determine which schedule is suitable for your business.

What’s a Pay Period?

A pay period is a duration between one pay date to the next. If you pay your employees weekly, the week serves as the pay period. If you pay workers twice monthly, you’ll have two pay periods each month and 24 pay periods every year. The type of payroll schedule you choose determines your pay periods.

The 4 Types of Payroll Schedules

The most common types of payroll schedules include:

- Weekly

- Bi-weekly

- Bi-monthly/Semi-monthly

- Monthly

Here’s a look at each of them:

Weekly

In a weekly payroll schedule, employees are paid every week. This translates to 52 pay periods every year. A weekly payroll schedule is suitable for businesses with independent contractors or freelance workers paid hourly. It’s also a great option for paying workers who work overtime.

Pros

- It’s great for employees: Most employees like getting paid as soon as possible, and a weekly payroll schedule is highly preferred. This is especially true with non-permanent workers with irregular work schedules.

- Perfect for overtime payments: Paying for overtime hours is easier on a weekly schedule than other lengthy schedules. Overtime payments will be irregular every other week based on how many hours employees put in. Allowing them to remain uncalculated or unpaid for longer periods can lead to more tasking budgeting down the line.

Cons

- Too much work for employers: With a weekly payroll schedule, you have to run payroll every week, 52 times every year. This requires a lot of time commitment from your payroll team, especially if you have a large workforce.

- It’s costly: If you’re using a payroll service provider who charges a fee for every time you run payroll, the process will cost you considerably throughout the year.

Bi-weekly

You’ll pay your employees every other week with a bi-weekly payroll schedule. This results in 26 payroll periods each year, half as much as you get with a weekly schedule.

Pros

- Less time-consuming for employers: When you pay your employees once every two weeks, you’ll spend half as much time processing payroll as with a weekly schedule. This also results in fewer costs spent on outsourced payroll services and providers.

- Suitable for hour-based payments: The sooner you can calculate and pay hourly-based payments, the better it is for your budgeting.

Cons

- Makes monthly deductions tricky: Bi-weekly payments do not smoothly transition into monthly schedules. Unlike a weekly schedule, you’ll have to pay more attention when determining when to include deductions such as health insurance payments.

Bi-monthly

Bi-monthly payroll schedules have 24 pay periods every year. This means that in every month of the year, you’ll make two payments. Many businesses make payments on either the 1st and 15th or the 15th and 30th.

A bi-monthly payroll schedule is more employer-friendly than a bi-weekly one because it makes monthly budgeting and reporting much easier. For employees, there’s the certainty of receiving payments consistently on the same dates every month.

Pros

- Consistent pay dates: Employees receive payments on consistent dates when payroll is on a semi-monthly basis. This increases employee satisfaction since it simplifies personal financing.

- Lower time and cost requirements: Time and money spent running bi-monthly payroll are less than with weekly and bi-weekly schedules. This makes it more convenient for employers.

Cons

- Payday irregularities: Since bi-monthly payroll schedules feature fixed pay dates, paydays occasionally fall on weekends or holidays. This creates a delay in how fast employees can access their payments.

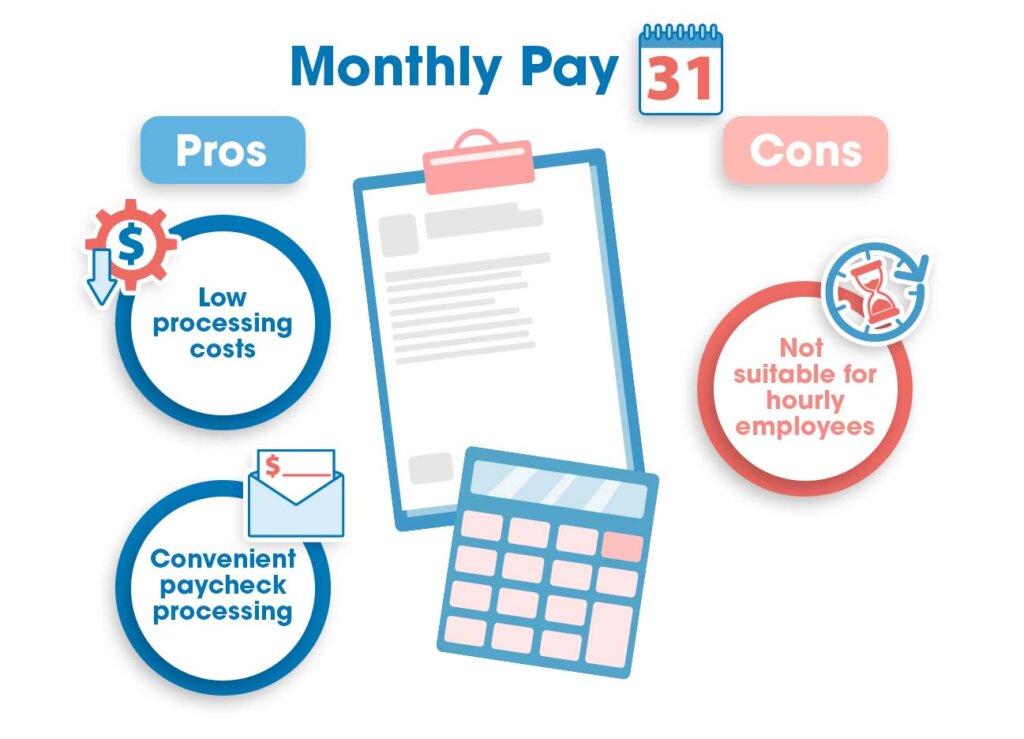

Monthly

The monthly payroll schedule comprises 12 pay periods throughout the year. Compared to other schedules, this is the most convenient for employers. Often used for salaried workers, a monthly payroll schedule uses up the least resources regarding time, money, and paycheck processing.

Pros

- Low processing costs: Since there are only 12 pay periods each year with a monthly payroll schedule, it incurs minimum expenses compared to all other types of schedules.

- Convenient paycheck processing: Making deductions is easiest when paying employees monthly. This makes paycheck processing much more convenient than with weekly or bi-weekly schedules.

Cons

- Not suitable for hourly employees: Many hourly workers may not be willing to wait an entire month to receive their pay, and many states require employers to pay such workers more frequently.

Tip

If you want to save money on payroll, consider using the best free payroll software. It’s easier than doing it by yourself, and more affordable than hiring a payroll service to do it for you.

How to Choose a Payroll Schedule for Your Company

To choose the right payroll schedule for your company, you must first consider several factors. These include the following:

State Laws

Different states have different payday requirements governing payroll schedules. Regulations differ between industries and occupations, so it’s important to check specific laws affecting your business.

For instance, in Arizona, employers must have two or more paydays in a month, and they should not be more than 16 days apart. In New York, manual workers should be paid weekly, while a semi-monthly payroll schedule is required for clerical and other workers.

The only exceptions are South Carolina, Florida, and Alabama. These three states don’t have specified payroll frequencies, so how often you pay your workers is up to you.

Types of Employees

Are your workers salaried, hourly, or on contract? A monthly or semi-monthly schedule is suitable for salaried employees, but more frequent payments are better for hourly workers.

This is not just because of simplified paycheck processing but also because of employee satisfaction. A shorter pay period may be more favorable for hourly workers who earn irregular incomes over different durations.

Read: How to Process Contractor Payroll in 6 Steps

Cash Flow

Having an established payment schedule on paper will not serve much purpose if you cannot pay employees on time. Employees prefer working for businesses that can pay them on time, so ensure to settle on a schedule that your cash flow can support.

Frequently Asked Questions (FAQs) for Payroll Schedule

Here are answers to frequently asked questions regarding payroll schedules:

Bottom Line on Payroll Schedules

Paying employees consistently without delay ensures smooth business operation and maintains the business’s reputation. Fortunately, you have several payroll schedules to pick from, making it easier to choose a reliable frequency. Be sure to keep crucial factors such as your company’s financial capabilities and state regulations in mind.

Sections of this topic

Sections of this topic