Lili is an all-purpose bank account that helps sole proprietors and freelancers manage their business finances, thanks to its tax optimizer tools, built-in expense tracking, and budget-friendly pricing. In this Lili review 2023, we’ll take a closer look at its pricing, features, pros, cons, and competitors.

Our Verdict

Lili is a versatile banking solution for small business owners and independent contractors who plan to open a business account. First, it makes it easy for you to file taxes and increase tax savings. Next, it allows you to monitor your business expenses on the go through the mobile app. Finally, there’s a free business account available, while the paid account is also affordable.

To be realistic, Lili does have some shortcomings too. To begin with, you can only earn interest if you sign up for the paid account, but not the free version. Also, while Lili covers overdrafts up to $200 for the paid account, the same coverage isn’t available for the free version. Lastly, the customer service is only limited to email support on weekdays during business hours.

As we’ll discuss in this review on lili, it’s a low-cost account with practical features that can be helpful for beginners in business banking. Check out the summary of the benefits and drawbacks of Lili:

- Tax optimization tools

- Built-in expense management

- Economical pricing

- Zero APY for free account

- Overdraft protection for paid account only

- Skimpy customer support

Pricing: Starts at $0

Lili at a Glance

Lili is a financial technology company that offers business banking accounts through its partner Choice Financial Group. Its mission is to empower small business owners and freelancers to grow their business through banking services. Established in 2019 by Lilac Bar David, there are now over 100,000 users of the Lili app.

Lili is distinct from other bank accounts because it comes with extra tools for tax and business management. The features we’ll focus on in this review are mobile checking, ATM services, BalanceUp, APY, direct deposit, cash deposit, debit card, cashback rewards, expense tracking, tax optimizer tools, invoice tools, mobile app, security, and customer support.

Who Lili Is Best For

Lili is suitable for owners of sole proprietorships who need an affordable yet useful business banking account. After all, the free account doesn’t require you to pay any monthly fees, while the paid account only charges a minimal monthly fee.

Plus, it comes with handy business solutions like mobile checking, tax tools, and expense tracking which helps you manage your professional funds. In spite of its cheap price, Lili is more than enough as a bank for startup entrepreneurs or independent contractors who wish to jumpstart their business.

Pricing on Lili

Lili offers two types of business bank accounts for small business owners and freelancers. Compare the similarities and differences between the two accounts by exploring the chart below:

Price

$0/month

$9/month

Minimum Balance

$0

$0

Mobile Checking

ATM Services

Free at 38,000+ MoneyPass ATMs

Free at 38,000+ MoneyPass ATMs

BalanceUp

APY

None

4.15%

Direct Deposit

Up to 2 days faster

Up to 2 days faster

Cash Deposit

Third-party retailers

Third-party retailers

Debit Card

Visa Business Debit Card

Premium Visa Business Debit Card

Cashback Rewards

Expense Tracking

Basic

Advanced

Tax Optimizer Tools

Invoice Tools

Mobile App

Android + iOS

Android + iOS

Security

FDIC insurance + Encryption + Freezing/unfreezing

FDIC insurance + Encryption + Freezing/unfreezing

Customer Support

Weekday email support, 9 a.m. – 7 p.m. EST

Weekday email support, 9 a.m. – 7 p.m. EST

To sum things up, there are two kinds of Lili business bank accounts which you can select from:

- Lili Standard (Free): The basic account doesn’t require you to pay any monthly fees or maintain a minimum balance.

- Lili Pro ($4.99/month): The paid account charges a low monthly maintenance fee, but there’s no minimum balance requirement.

Lili Standard is a good deal for you if you’re on a tight budget. However, if you can afford the extra expense, it’s worth upgrading to Lili Pro because it comes with more major features for just a small amount each month.

Lili Bank Offers a Lot of Features

If you start a Lili bank account, you can benefit from essential banking services and tools. In this Lili business account review, let’s talk about mobile checking, ATM services, BalanceUp, APY, direct deposit, cash deposit, debit card, cashback rewards, expense tracking, tax optimizer tools, invoice tools, mobile app, security, and customer support.

Mobile Checking Lili Bank

Lili offers you a business checking account that’s particularly designed for small business owners, whether they operate as sole proprietors/single-member LLCs or multi-member LLCs, partnerships, or S corporations. You can easily manage your account anytime, anywhere through the mobile banking app. Plus, you can perform mobile check deposit transactions even when you are on the go.

ATM Services Lili Bank

Lili makes it possible for you to withdraw your money for free from MoneyPass ATMs. At present, there are more than 38,000 no-fee ATM machines all over the U.S. You can find the closest ATM in your area with the assistance of the ATM locator in the mobile app.

Take note that you must pay a $2.50 fee if you withdraw cash from an ATM that’s not part of the MoneyPass network. Also, you will be charged a $5 fee if you make withdrawals outside of the country.

If you want to open a fee-free business account, here is a thorough BlueVine Review, Bank of America Review, and Kabbage Review with information on the pros, cons, and alternatives.

BalanceUp

Lili provides overdraft protection via BalanceUp. Aside from not charging penalty fees, the company covers overdrafts up to $200 on purchases you make through your debit card. However, this feature is only available for Pro depositors, not Standard customers. If you open a Pro account, you’ll receive a notification that you can enroll in BalanceUp once you meet the eligibility requirements.

APY

Lili grants a 4.15% APY incentive for customers who open an emergency savings account. You can set up an automatic transfer of $1 or more daily. Afterwards, you’ll have the chance to earn interest, as long as you maintain a minimum savings balance of $0.01. Nevertheless, this option is only open to Pro clients, not to Standard depositors. Keep in mind that the APY rate can change over time since it’s variable.

Direct Deposit on Lili Bank

Lili gives you the opportunity to receive your money quickly through direct deposit. It’s possible for you to get your paycheck deposits or client payments as early as two days in advance. All you need to do is set up direct deposit with your Lili account. Then, you’ll start receiving notifications as soon as the funds are transferred to your account. Thankfully, in this case, early direct deposit is available for both Standard and Pro accounts.

Cash Deposit on Lili Bank

Lili is a financial technology company, not a conventional bank. As a result, it doesn’t have any physical branches where you can drop by to deposit your paper bills. However, Lili has partnered with third-party retailers with over 90,000 locations in the U.S. where you can deposit cash to your Lili account, such as Walmart, RiteAid, and CVS.

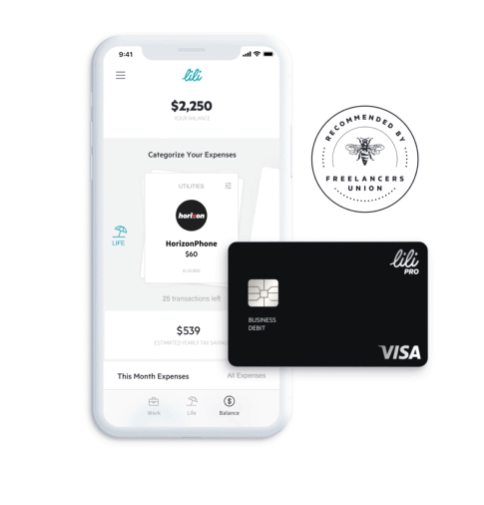

Debit Card

You will get a Lili debit card whether you sign up for a Standard or Pro account. If you go for the free version, you’ll receive a Visa Business Debit Card. In case you select the Pro edition, you will gain a Premium Visa Business Debit Card. Either way, there’s no need to worry about transaction or service fees when you use the card for online or in-store payments. Still, there’s one major difference between the two types of cards, which we’ll talk about in the next section.

Cashback Rewards

The main advantage of the Premium Visa Business Debit Card over the regular Visa Business Debit Card is cashback. If you’re a Pro customer, you’ll have the chance to earn cashback rewards whenever you buy products or services from participating merchants.

As a result, you can save money on your business or personal purchases from Microsoft, TaxAct, Mailchimp, Chevron, and Autozone. Sadly, you won’t have the same incentives as a Standard depositor.

Expense Tracking

Lili is unique among business bank accounts because it makes it easy for you to manage your expenses. On one hand, the Standard account comes with a built-in expense tracking tool which lets you sort your expenses into categories in real-time. On the other hand, the Pro account includes an advanced expense tracking capability which helps you increase your tax deductions.

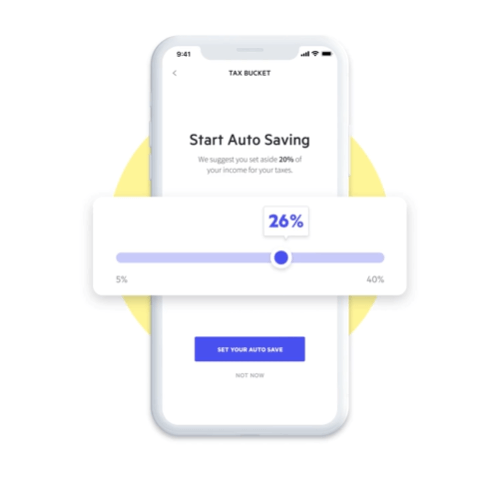

Tax Optimizer Tools

One of the most important strengths of Lili is that it boasts a rich set of tax optimizer tools which helps you meet IRS tax requirements for sole proprietors. First, the Tax Bucket makes it simple for you to set aside a portion of your income for your taxes. Plus, the Write-Off Tracker boosts your tax savings by dividing your transactions into business and personal categories.

In addition to this, the Receipt Scanner records and stores an image or PDF file of your receipts. To top things off, Lili can pre-fill your annual 1040 Schedule C form to save time before you send it to your accountant or file it with the IRS. Last but not least, it generates automated quarterly and annual expense reports so you can have an overview of your spending patterns.

Invoice Tools

Another advantage of Lili is the invoice tool set. It enables you to quickly create and edit unlimited invoices via the mobile app. Afterwards, you can send them to your clients to request for payments for your services or products. Aside from this, you can file and organize all the invoices you made to update your business records.

Mobile App

The Lili mobile banking app is free to download from the Google Play Store and Apple App Store. You can install it in your Android or iOS smartphones and gadgets. Aside from the mobile checking deposits, you can also make contactless payments through your mobile phone. Also, the app sends you push notifications so you can be aware whenever cash goes in or out of your business account.

Security

Lili takes measures to safeguard your funds in different ways. First, your account will be insured up to $250,000 via Choice Financial Group, the partner bank of Lili. Next, it protects the privacy of your data through industry-grade security encryption. Lastly, you can directly freeze and unfreeze your card via the mobile app if necessary.

Customer Support

One of the obvious drawbacks of Lili is the limited customer service. It doesn’t offer any phone or chat support, which means you can’t communicate in real-time with live agents. Instead, it only allows you to email the support team on weekdays, from Mondays to Fridays, and only during business hours, 9 a.m. – 7 p.m. EST.

Also, you can’t even send the message directly from the website since there’s no contact form. You must use your desktop or web email client to send an email. To make things a little better, there’s a help center where you can conduct self-research about basic information on Lili.

The Alternative Bank Sites to Lili Bank

Lili is an interesting choice if you need a multipurpose business account that won’t break the bank. Nevertheless, you can explore other alternatives if you have other banking needs that Lili doesn’t cover.

Kabbage is a registered payment service provider that offers a free business checking account. It’s ideal for ambitious entrepreneurs who need loans to grow their venture. It presents flexible financing options for small businesses, which Lili doesn’t provide. Just keep in mind that you need to provide a personal guarantee when you apply for a loan.

Plus, Kabbage gives you the chance to earn 1.10% APY on balances up to $100,000 for the free account, unlike Lili which only gives interest for the paid account. Also, it allows you to accept payments via professional invoices, similar to Lili.

However, Lili is better than Kabbage when it comes to business management. After all, it comes with automated tools for tax filing and expense management, while Kabbage only provides how-to guides on these topics.

Pricing: Starts at $0/month

- Loan offers

- 1.10% APY for free account

- Invoice payment processing

- Personal guarantee required for loans

- Lack of tax optimization tools

- No automatic expense management

Novo is a financial technology company that provides a free business checking account. It’s fitting for small business owners who want to integrate their business account with other productivity solutions.

On one hand, it connects to bookkeeping software like Quickbooks and online payment platforms like Stripe, compared to Lili which has built-in financial management tools instead. In addition to this, Novo specializes in ACH and wire transfers, while Lili focuses more on regular banking transactions.

On the other hand, Lili has an edge because it lets you deposit cash through partner retailers, unlike Novo. Aside from this, it gives you the chance to open an emergency savings account, while Novo is purely a checking account. Still, both Novo and Lili are equal when it comes to a lack of loan offerings.

Pricing: Starts at $0/month

- Strong third-party integration

- No monthly service fees

- Free ACH transactions

- No cash deposits

- Can’t open savings account

- No loans or credit lines

Oxygen is a financial technology company that offers business and personal bank accounts. It’s suitable for enterprising entrepreneurs and freelancers who want to earn extra income through business banking.

All Oxygen business accounts grant you an APY and cashback rewards, while Lili only gives these benefits to users of the paid account. To top things off, Oxygen has daily phone and email support, in contrast to Lili that only includes weekday email assistance.

Nevertheless, Lili has an advantage over Oxygen because of its business management specialization. It has features like expense monitoring and tax savings, which Oxygen lacks. Also, the paid account of Lili is more cost-effective than the paid tiers of Oxygen.

Pricing: Starts at $0/month

- APY for all tiers

- Cashback rewards for all users

- Daily phone & email support

- No expense tracking tools

- No automatic tax savings

- Expensive rates for paid tiers

Frequently Asked Questions (FAQs) for Lili Bank

Lili enables small business owners and freelancers to manage the various aspects of their professional assets. Discover the answers to basic questions about Lili and sole proprietorship.

Bottom Line on Lili Review

Lili is an all-in-one business bank account that works well for sole proprietors and independent contractors. It’s an accessible option for you if you’re looking for a combination of competitive pricing, tax savings assistance, and expense management. As we conclude our review on Lili bank, it’s time for you to come to a conclusion if Lili is the best banking solution for you.

Best Business Bank Accounts by State

Below you will find an interactive U.S map that can help you locate and compare different banks and financial institutions that offer business accounts in your area.

Sections of this topic

Sections of this topic