As a business owner, learning how to calculate payroll taxes are one of the most daunting tasks to tackle. Among all the other aspects of your business that you manage, it’s also essential you calculate your taxes correctly. Without accurate tax calculations, you can face legal and financial penalties if the IRS investigates your business.

Payroll taxes are entirely your responsibility as a business owner so let’s dive into how to calculate them.

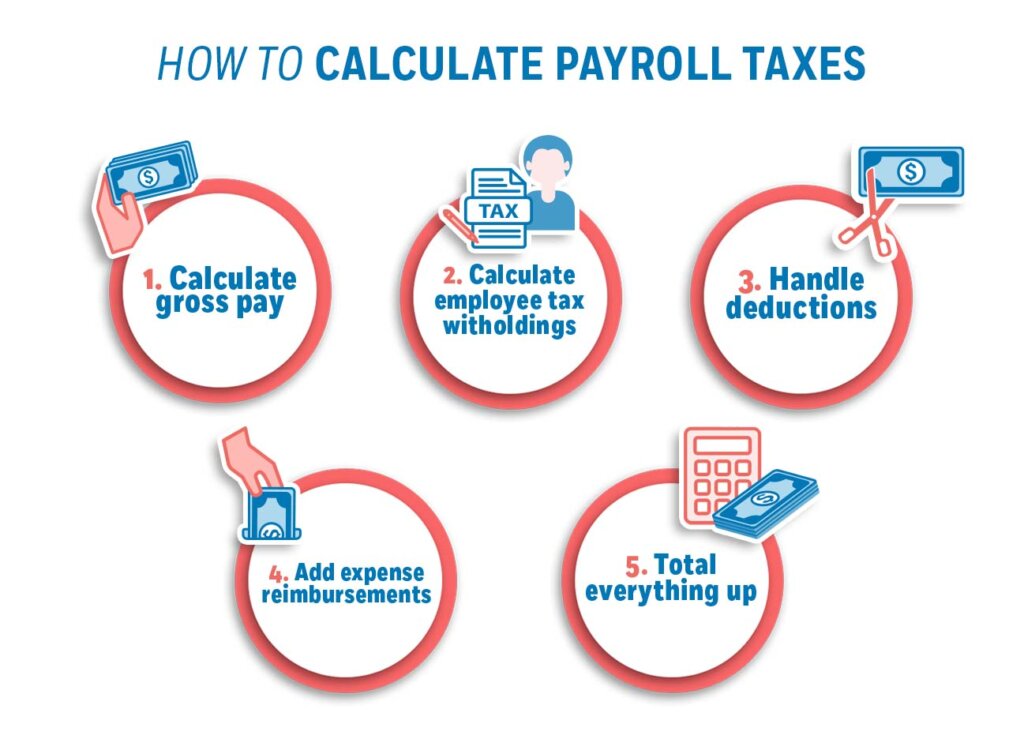

How to Calculate Payroll Taxes in 5 Steps

Payroll taxes are taxes employers pay on behalf of their employees. The exact amount of tax is determined by each employee’s salary, wage, and tips. These taxes are used to finance social security programs, including Medicare and Social Security.

The most significant portions of the social insurance taxes are the federal payroll taxes, which appear as Medicare (MEDFICA) and Federal Insurance Contributions Act (FICA) tax on the employee’s pay stub.

As a business owner, you may be surprised to learn that employees effectively pay around half of the whole payroll tax with their wages, with a smaller contribution from you. Payroll taxes are directly deducted from each employee’s earnings and sent to the Internal Revenue Service (IRS).

Before you start calculating payroll taxes, your employees need to complete these documents:

- Form W-4: Employee’s Withholding Certificate

- State W-4 (as applicable)

- Direct Deposit Authorization Form

- Form I-9: Employment Eligibility Verification

Step 1: Calculate Gross Pay

The first step to calculate payroll taxes is calculating the wages earned by each employee and the amount of taxes that need to be withheld as part of running payroll. You also need to make deductions for items such as retirement benefits, health insurance, and garnishments. Expense reimbursements will have to be added back as well.

Gross pay is calculated differently for hourly salaried employees.

Calculating Gross Pay for Hourly Employees

You calculate gross pay for hourly employees by multiplying the number of hours they worked during the pay period by their hourly rate. For example, if the employee worked 40 hours in the week at $30 an hour, their gross pay is $1,200.

Remember to include overtime pay, which is typically 1.5 times the normal hourly rate if the employee works more than 8 hours a day or 40 hours a week. Here’s a comprehensive process of how to do payroll for contractors and freelancers.

Calculating Gross Pay for Salaried Employees

For salaried employees, simply divide their salary by the number of pay periods in a tax year. For instance, if an employee earns an annual salary of $60,000 and receives a paycheck twice a month, their gross pay for each pay period is $2,500 ($60,000/12 months/2 monthly pay periods)

Make sure to add on commissions, tips, and bonuses the employee earns to calculate the total gross pay.

Step 2: Calculate Employee Tax Withholdings

The next step is to calculate the employee’s tax withholdings. Once you have the employee’s gross pay and the number of allowances from their W-4 form, you can begin to calculate how much you need to withhold to cover their taxes.

For the majority of states, you’ll need to withhold both state and federal taxes as well as FICA taxes from each paycheck.The information on the W-4 states how much income tax needs to be withheld from the employee’s paycheck each pay period. The employee will claim their marital status and the number of allowances they have on the W-4 form. You need this information to calculate their FICA, federal, and state taxes.

Calculate Federal Income Taxes

Assuming the employee completed the W-4 in 2020 or later, you would use the updated tax tables found in Publication 15-T, Federal Income Tax Withholding Methods.

This process involves:

- Adjusting the employee’s wage amount

- Determining the tentative withholding amount

- Accounting for tax credits

- Tallying the final withholding amount

Calculate FICA

You and the employee both contribute 7.65% to FICA, including 6.2% for Social Security and 1.45% for Medicare. The first $137,700 of an employee’s wages are subject to the Social Security tax. Employees earning more than $200,000 are subject to an additional Medicare tax.

Let’s follow the example from above with a gross pay of $2,500 per pay period:

- Social Security: $2,500 x 6.2% = $155

- Medicare: $2,500 x 1.45% = $36.25

The employee’s total FICA withholding is $191.25 (155+36.25).

As the employer, you are responsible for the same amount in FICA taxes.

Calculate State and Local Tax

The next step is to calculate any state taxes the employee is responsible for. Some states, like Texas, have no state income taxes. The other eight states without an income tax are Alaska, Tennessee, Wyoming, New Hampshire, Florida, South Dakota, Nevada, and Washington. So check your state’s income tax guidelines and follow them accordingly.

Let’s follow the example from above and imagine that your business is based in New Mexico.

For New Mexico, the wage withholding table states that you need to deduct $64.67 along with an additional 4.9% of the surplus amount over $2,183.

We calculate this by:

- $2,500 – $2,183 = $317

- $317 x 4.9% = $15.53

- $64.67 + $15.53 = $80.20

You will need to deduct $80.20 from each paycheck to withhold for New Mexico state income tax.

Step 3: Handle Deductions

After you calculate the employee’s tax withholdings, the next step is to take out any applicable deductions. These are voluntary pre- and post-tax deductions such as 401(k) plans, health insurance premiums, or health savings account contributions.

Certain employees will have involuntary deductions like wage garnishments or child support that need to be considered. You’ll receive an order from the state, the IRS, or a judge which tells you to withhold these items.

It’s important to be cautious and accurate here because pre-tax deductions like 401(k)s are taken out of gross income in step 1. This means that tax withholding calculations in step 2 will be reduced and pre-tax deductions save the employee more on taxes. Post-tax deductions are calculated after step 2.

Step 4: Add Expense Reimbursements

If an employee paid for company expenses with their own money, they need to be reimbursed. As an employer, you can either pay reimbursements by combining them with payroll or separately from payroll.

Expense reimbursements are not included in gross wages. This means they are not subject to tax withholding. All expenses you reimburse to employees should be paid in full and added on to net pay at the end of your calculation.

Step 5: Total Everything Up

After you’ve completed all the calculations to determine gross pay, tax withholdings, deductions, and reimbursements, you’ll be ready to calculate the paycheck:

- Begin with gross pay

- Subtract employee tax withholdings

- Subtract deductions

- Add expense reimbursements

- Arrive at net pay

Net pay is the amount of money you need to send to the employee come payday.

Following the example above, let’s walk through the calculation:

Summary of how to calculate payroll tax:

Gross Pay

$2,500

Federal Withholding Tax

Calculated from W-4 and Publication 15-T form

Social Security Tax

-$155

Medicare Tax

-$36.25

New Mexico Income Tax

-$80.20

Net Pay

$2,228.55 – Federal Withholding Tax

The employee’s net pay is $2,228.55 minus their specific federal withholding tax.

Calculating Employer Payroll Taxes

Now that you know how much of the employee’s paycheck to withhold for taxes, it’s time to calculate how much you’re responsible for as the employer.

FICA Matching

You must match the employee’s FICA tax withholding, which means your business will also pay 6.2% for Social Security and 1.45% for Medicare. Using the previous example, you would need to match the employee’s $191.25 FICA obligation.

Unemployment Taxes

As the employer, you also have to pay federal and state unemployment taxes. These taxes are only paid by the employer and not the employee.

Federal Unemployment Tax (FUTA)

FUTA is 6% of the first $7,000 in wages you pay to each employee every year. If your company is subject to state unemployed tax, you’re also subject to a federal tax rate credit of up to 5.4%. This makes the effective tax rate 0.6%. When an employee earns more than $7,000 in a calendar year, you stop paying FUTA taxes for that specific employee in that tax year.

Following the example from above, federal unemployment tax: $2,500 x 0.6% = $15

State Unemployment Tax (SUTA)

SUTA varies from state to state. We recommend you consult with your state’s Unemployment Revenue or Department of Labor for tax rates, filing requirements, and wage bases.

Paying the IRS

Once all the heavy calculations are complete, your next step is to send the tax payments to the proper taxing authority. For federal income tax and FICA, you send this to the IRS. Payments need to be sent to your state’s withholding tax agency for state and local income taxes.

Make sure you send both the taxes you withheld from the employee’s paycheck and the taxes you owe as the employer.

The comprehensive way to calculate payroll taxes include:

- Federal withholding

- Social Security (employee portion)

- Medicare (employee portion)

- State income tax (if applicable)

- Social Security (employer portion)

- Medicare (employer portion)

- FUTA

- SUTA

This adds up to the total payroll taxes you must pay.

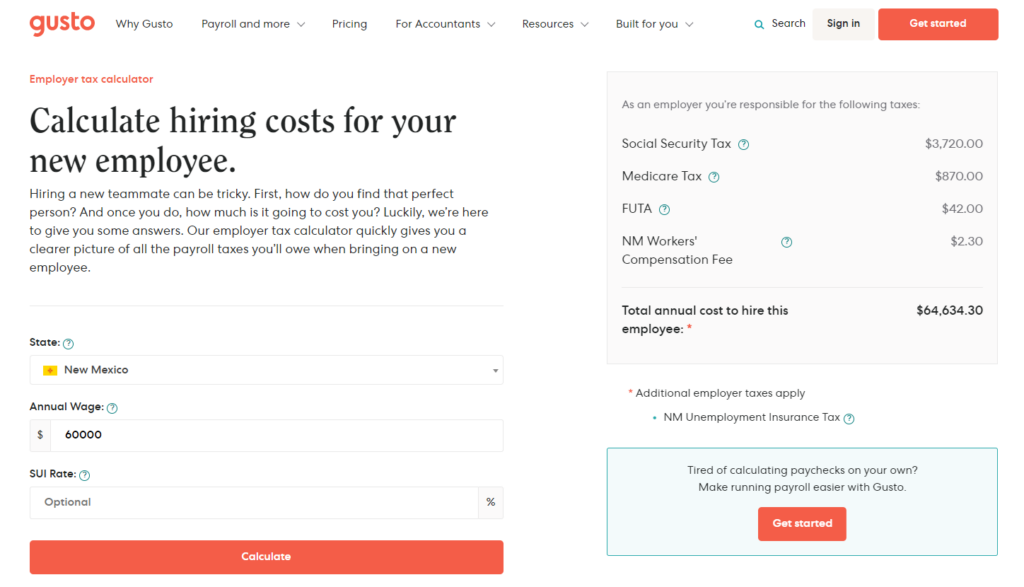

How to Calculate Payroll Taxes with Gusto

Although it’s manageable to calculate payroll taxes manually, this isn’t recommended. Taxes require accuracy, and a small mistake in your calculations can lead to disaster in the future.

This is especially true if you have a lot of employees. It’s not only time-consuming to manually calculate payroll taxes for each of them, but you are also putting yourself at an increased risk of making a mistake.

We recommend using Gusto, a payroll software that automatically calculates payroll taxes for you. It also automates payroll, includes an employee self-service portal, and offers some human resources (HR) tools. It regularly tops lists of the best payroll software for small businesses.

Gusto has a free employer tax calculator which provides an accurate estimate of how much you’ll have to pay in payroll taxes over a year.

To completely calculate your payroll taxes, you’ll need to register for an account and enter each employee’s Form W-4 details.

Frequently Asked Questions (FAQs) for How to Calculate Payroll Taxes

We understand that payroll taxes are confusing, so here are a few common questions and answers to provide more clarity.

Bottom Line on How to Calculate Payroll Taxes

Calculating payroll taxes is entirely manageable as a business owner. As long as you know which numbers to use and what steps to follow, you’ll end up with an accurate number. The overall goal is to start with the employee’s gross pay and end with their net pay. The difference between the two is the employee’s withholdings you need to pay as payroll taxes on behalf of the employee.

Sections of this topic

Sections of this topic